One good way to earn passive income is to invest your money in dividend yielding stocks. There are plenty of stocks out in the market that issue dividends. On the top of my mind are banks, such as BPI, which has consistently issued dividends to its stock owners.

We are informed of a company's dividend announcement via different channels - in my case, I go to the individual company websites in multiple research domains until I stumble on one. At first glance, these announcements do not look too important, but here are the things that you need to know about dividend announcements:

1. The Company - need I say more?

2. The Ex-Date - this is the date before which you should hold the stock. Only the stock owners who have purchased the company's stock before this date is eligible for the dividends.

3. Amount - the amount to be issued as dividend per stock.

4. Payment Date - this is the date when the dividends will be reflected on your account, but I guess it depends on your broker's turn around time on things.

5. Others - sometimes there are more dates listed on the announcement, but try to tune out the noise if you can, because basically, all you need are the four items above... Plus your fundamentals. :p

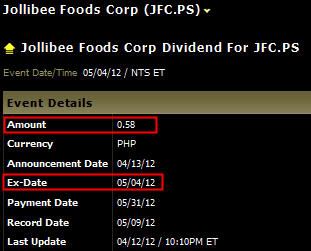

So, to review, the things you need when looking at dividend announcements are: The Company, Ex-Date, Amount, and Payment Date. Let's apply what we learned today on the example below:

Here's a dividend announcement for Jollibee Foods Corp which I stumbled upon on Thomson Reuters' website (a very good reference, if I may add, try it! :D). To interpret, JFC is issuing 0.58 cents on every stock owned before May 04, 2012. If you bought 50 stocks before May 4, you'll end up earning dividends worth P29 by May 31, 2012. The more stocks you own, of course, the more dividends you earn.

I go about multiple websites looking for these dividend announcements because it's one of the easiest ways to earn money. As a rule, I buy short positions on these stocks only if the dividend offer is significant, if I have time to put up some money to buy the stocks, and if the company is fundamentally doing good (ie. the Rate of Equity is double digits and increasing, there's the ROI/A is above 5%, price trend is safe or upward, etc.).

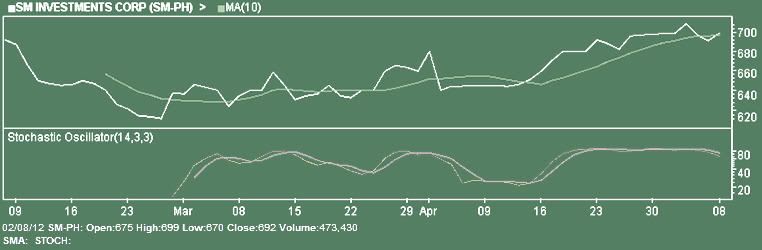

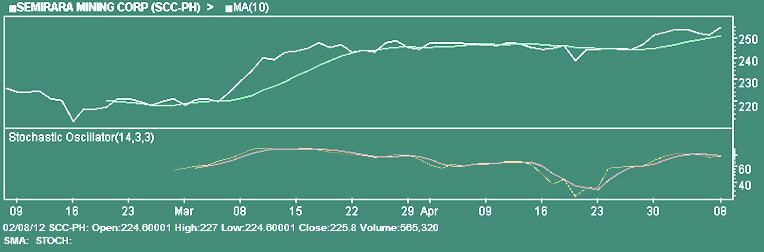

So, upon doing further research, which one should I choose between the two:

SM Investments

Semirara Mining

Here are their 6 months price charts (in case you're leaning to the technical side of things):

SM

SCC

Happy trading!

-that's yuuuuge-

No comments:

Post a Comment