I'm back! Gahd I missed my station. (not)

These past few days I was on leave to celebrate my birthday. I was in Batangas with my mom, and we spent days following the trial on the then chief justice of the Philippines Renato Corona. After a long session at court and a lengthy tv coverage, he was eventually impeached and won't be allowed to take any office in the government.

I had to engage my mom into a debate because the feeds in Twitter couldn't be ignored. My original position was Convict, only because I care about the taxes I pay - they should be used in purposes of the government and not personal investments. I also believed the law is absolutist, and like Loren Legarda said, the interpretations of the law should not blur the actual misstep committed by the prosecuted against the country. On the other hand, my mom says the non-declaration of some assets in the SALN are clearly honest mistakes and that is not compelling enough to remove the chief justice from his office. Later on I was just confused, and I can't stand my stand anymore so we just went somewhere and ate dinner. : \

Anyway, I only cared about this judiciary palooza because I know, in some way or another, it will affect the Philippine stock market. I've been reading a lot of releases on the internet and apparently, the impeachment's overall sentiment was good, not because somebody was impeached again in the Philippines, but because the whole process was carried out comprehensively sans violence, and it was completed lawfully. This resounded well among social weather agencies, saying this will strengthen the democracy in the country.

On a side note, I also read Gilbert Remulla's tweet saying, "Sooner or later, [we] will regret giving that much power to Malacanang..." (to that effect).

Anyway, so I looked back to the PSEi index, and true enough, the stock market reacted well on the trial. The PSE index closed above the 5,000 resistance mark (5,023 up by 1.34%).

On my end of the spectrum, things are looking even better. Check this out:

The price of my IPO subscription to the agrochemical company Calata Corp (symbol CAL) ballooned by 52.27% !! I mean, my original Php750.00 is now Php1,142.00! If this is how all IPO's turn out, I'm gonna have Thomson Reuters create me a watchlist of upcoming IPO announcements. :p

See, I originally asked COL Financial (my broker), to subscribe 800 shares for me. By the end of the day, the stock was oversubscribed (meaning a lot of people wanted the stock), so the broker had to raffle off the stocks instead (to be fair to everyone). I ended up receiving only a 100 shares for Php750.00. Disappointing since if I were accorded 800 shares, I would have paid Php6,000.00, and would have earned $9136.20 by this time (that's Php3,136.2 earned in a week! Or a pair of nice tassle shoes from Zara :p).

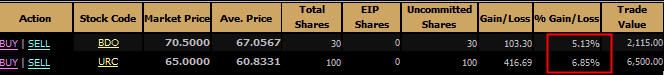

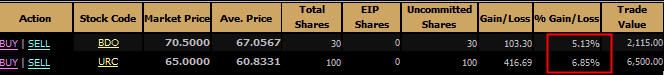

Well, that's how life goes in the stock market. Today I'm just glad that most of my assets are up. URC is also up by a meager 0.44%, enough to pay off the commisions I paid buying the stock.

Europe may be in crisis, but whoever said that's the only market to look out for?

On another note, we better watch out for possibilities of creating a free economic zone between China, Japan, and South Korea. Together, they will create one of the largest markets in the world, contributing to about 20% of the world's GDP.

As for the trial on chief justice Corona, I think we should just look back to that as a lawfully handled process. In the words of political scientist that I know (Eljay Bernardo), "Kung convict ka o acquit, basta ang intensyon mo ay sa ikabubuti ng bansa, nasa tama ka." (to that effect).

-I should start taking down my notes in verbatim-

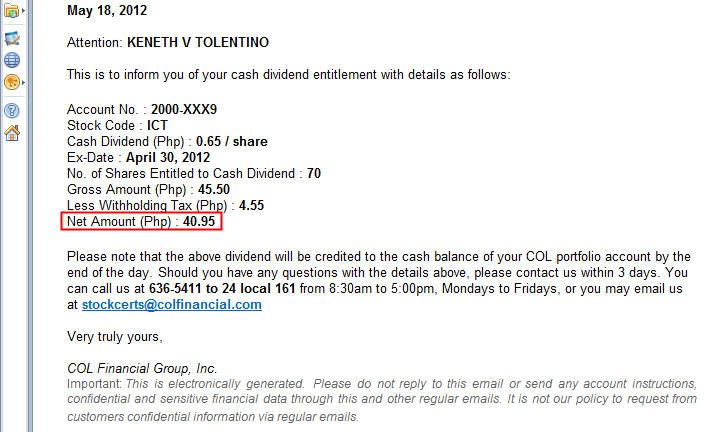

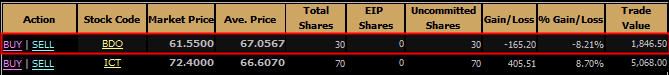

I'm only holding on to both stocks because both are paying dividends by the end of May (BDO to pay stock dividends at Php68.70 each while ICT pays out Php0.65/sh)

I'm only holding on to both stocks because both are paying dividends by the end of May (BDO to pay stock dividends at Php68.70 each while ICT pays out Php0.65/sh)