My portfolio's looking gorgeous!

I started this week with new purchases of DMCI stocks to complete my basket of Property/Service/Bank money generators. I've been reading extensively on property stocks lately because they're pulling in on the market, with a lot of foreign investments coming in. Of course, they've been volatile the first quarter of the year, but the earnings surprises are really enticing. Ayala Corp and DMCI, for example, are projected to benefit a lot from the Private-Public-Partnership plans (PPP) of the government. Property stocks are climbing to impressive levels so I thought why not join the bandwagon?

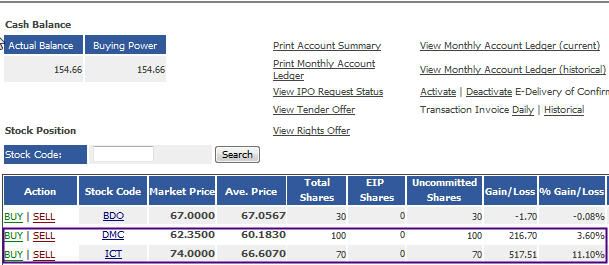

I bought DMC since it's way cheaper than AC (Php59.70/stock vs. Php430.00 - 04/30/2012 figures) and started out the week with a ~3% loss on DMC and and ~7% loss on BDO (!). Good thing my property stock did not fail to impress and it's now at a 3.6% gain. BDO's still stuck under but at least the loss is hardly recognizable now.

So here's how it looks like in my portfolio:

Not bad eh?

11.10% on ICT, you'll never get anywhere near that if you invest your money on Time Deposits, what more on your usual Savings Accounts!

Also, if you look at the bigger picture, the whole PSEi has surpassed it's time highs over and over again. That's why I'm having second thoughts on my mutual fund in BPI, which is invested on peso securities which are less reactive to the stock market. I should have opted for a balanced fund!

(Note: by balanced fund, it means part of the money you deposited will be invested on "safe" securities like government bonds, and the rest to more aggressive vehicles like the stock market).

Anyway, we'll just see what happens next week.

Henyway, tomorrow morning I'm having breakfast with my very good friends Pia and Tin at Johnny Rockets. Not so sure of the selection, as I think food there is severely overpriced, but we'll see.

-burger and fries for breakfast :/ -

No comments:

Post a Comment