Not a very good week for trade, I say.

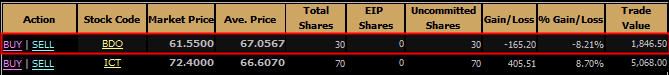

The Philippine Stock Exchange index is down again to 5083.62 by 1.44% at close yesterday. News of uncertainty in Europe is affecting our own bourse, and I find myself withdrawing most of my stocks back to my account at COL financial. Today, I only have two active issues: BDO and ICT:

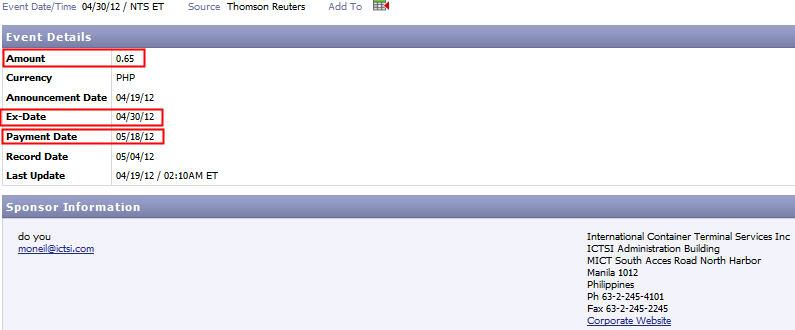

I'm only holding on to both stocks because both are paying dividends by the end of May (BDO to pay stock dividends at Php68.70 each while ICT pays out Php0.65/sh)

I'm only holding on to both stocks because both are paying dividends by the end of May (BDO to pay stock dividends at Php68.70 each while ICT pays out Php0.65/sh)

(From COL Financial website https://www.citiseconline.com/final2/xml/CompanyNews_nw.asp?varStock=BDO&varNewsLink=309944

From Thomson Reuters:

Sad. I lost 8.21% on BDO already. Looking back, I never really was lucky in banking stocks. I've invested on BPI and MBT before and even if they're the largest banks, they have never given me enough earnings to cover the losses from my initial investments and commissions payments. I remember I sold MBT at a loss too, of ~5.0%, while BPI, I was able to sell on a positive note, but I had to wait for a long long time before the stock yielded an earning. The first day it went positive, I sold.

Maybe, moving forward, I'll invest my money on more active stocks, like issues on Property or Holdings.

Which btw are both down yesterday, too.

First time seeing an all-red chart brings about bile in my mouth :((((. I can't blame Greece though if they don't want an austerity campaign to correct their economy. If you're a restaurateur in that country, you'll probably absorb all the austerity measures and see your menu inflate to accomodate the higher tax rates. It's normal that they wouldn't want these strict policies enforced. But would they risk not following the austerity measures from EU's German chancellor in exchange for being kicked out of the Union?

I wonder how reactive the Greeks are to front-loading...

Here in the Philippines, they say the market's walking a rocky road till July.

- huff -

No comments:

Post a Comment